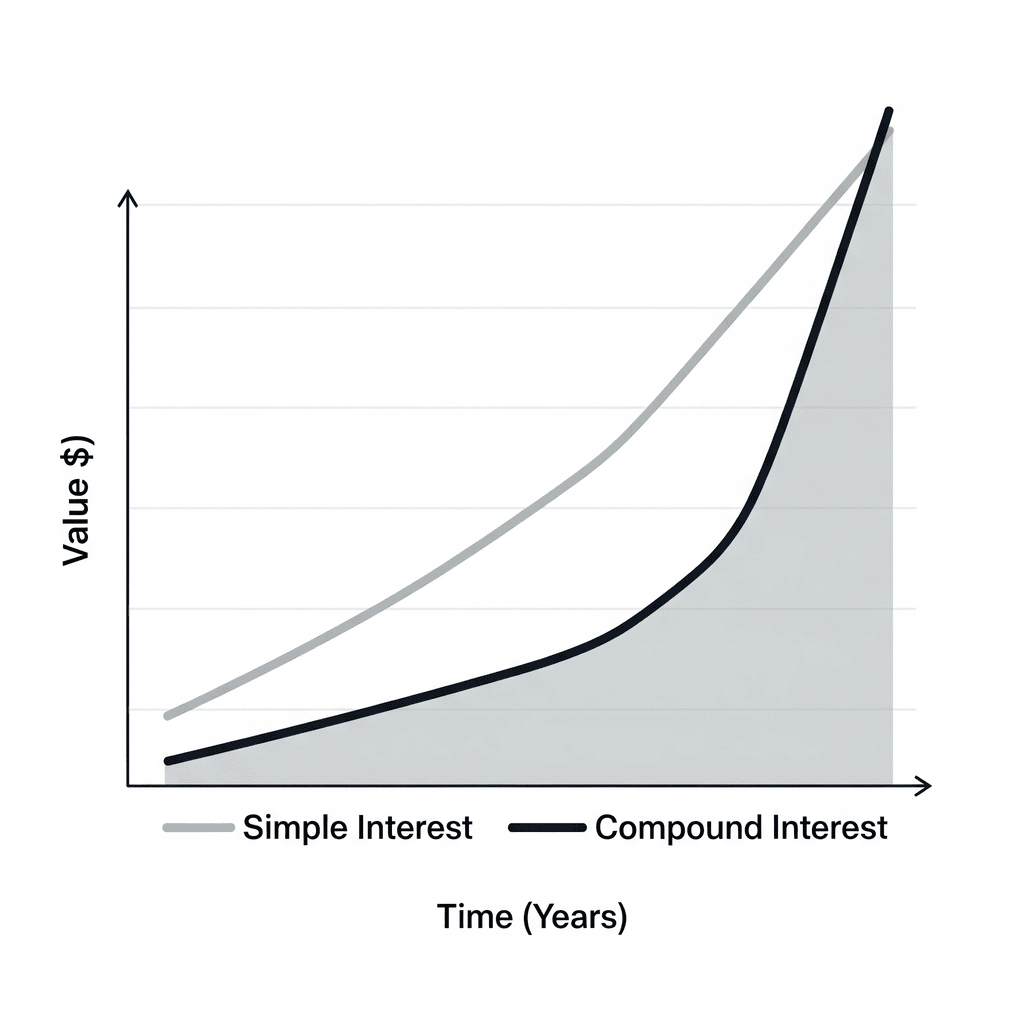

Have you ever felt that achieving wealth is incredibly slow, even after years of hard work? Many people believe the path to financial freedom is to follow the conventional path: go to school, get a job, save money, retire, and hope their wealth multiplies in their old age. However, the great secret that often goes unnoticed is this: the conventional “Slowlane” mindset and strategy is precisely what makes your journey feel endless. Through “The Millionaire Fastlane,” MJ DeMarco shatters this old model and offers a new path that is far faster, proven, and challenges the status quo of the financial world. Let’s break down the three foundations of wealth success—with one common thread: you can take back control of your life’s direction if you dare to change the way you think and act. What are the key concepts?

Why the Fastlane Mindset is Superior to the Slowlane

Most people have unknowingly fallen into the “Slowlane trap”—following the old playbook: get a good education, work hard, climb the corporate ladder, and hope that savings and investments will slowly accumulate in their accounts. The reality is, the world has changed. A single economic crisis, technological shift, or even a pandemic can wipe out all conventional plans in an instant. This is DeMarco’s sharp critique: the Slowlane is merely an illusion of security. It forces you to trade your time, sacrifices, and freedom today for the promise of results in an uncertain future. On the other hand, the Fastlane concept puts you in the driver’s seat. It’s not about waiting for fate or a promotion, but about creating a wealth-generating machine that leverages quality and speed. The Fastlane is a bold mindset that challenges “normalcy” and pushes you to build assets that can grow and generate income automatically. What makes the Fastlane radically different?

- Focus on Scale & Leverage: The Fastlane seeks ways for your time to have an exponential impact, not just trading time for money.

- Control Your Own Destiny: You stop relying on your company, boss, or the global economy to determine your future.

- Take Targeted Risks: The courage to try new things, learn quickly, and fail in a calculated manner becomes part of the Fastlane journey.

- Produce Results Faster: While the Slowlane offers to “get rich later,” the Fastlane allows you to enjoy the results sooner without sacrificing your youth.

With this shift in perspective, you will view opportunities, failure, and courage from a completely different standpoint. However, don’t be fooled: the detailed framework for building a Fastlane machine is laid out tactically and sequentially in the original book, covering everything from choosing a business model and mindset to execution—it’s not just a slogan or fleeting motivation. “The complete framework for building a scalable and future-proof Fastlane system is laid out step-by-step in the book The Millionaire Fastlane. A detailed summary and its practical steps can be found in more detail at MentorBuku…”

The Conventional vs. Fastlane Wealth Roadmap

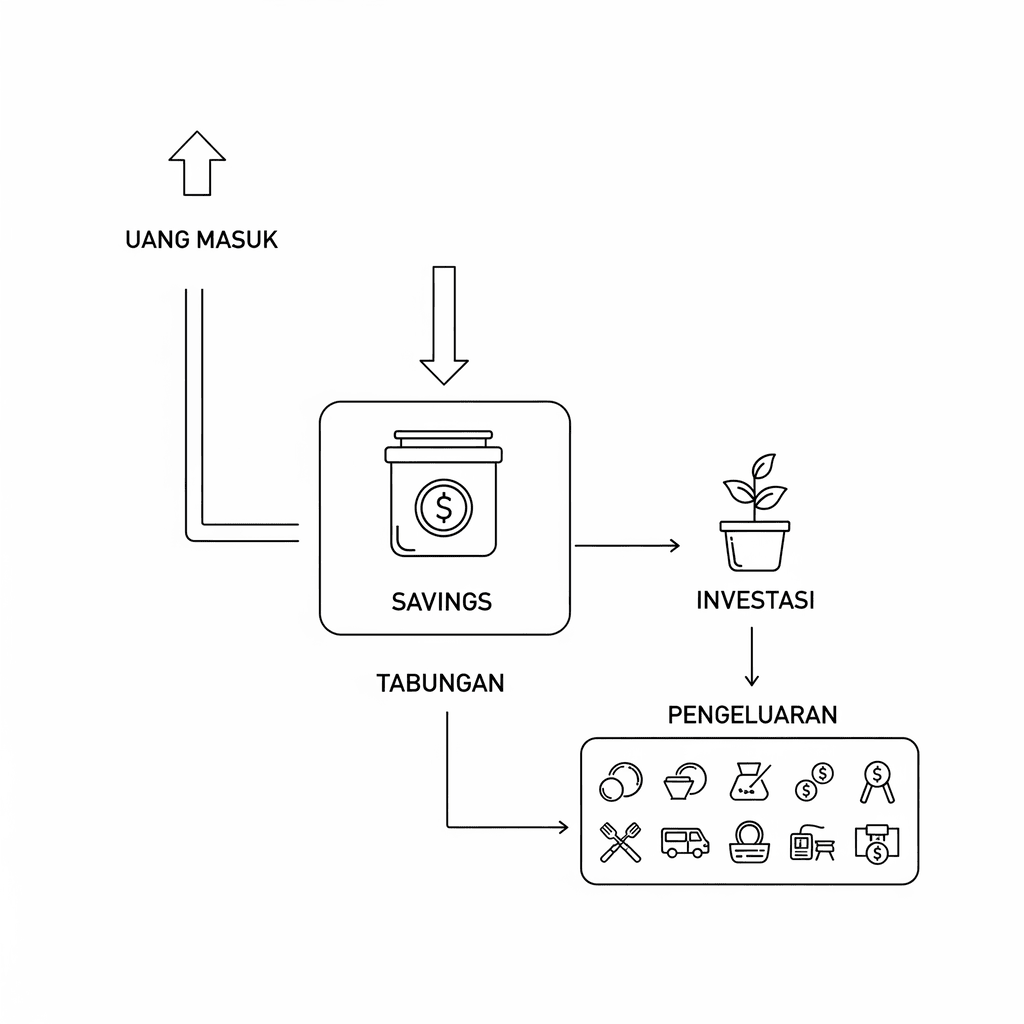

Let’s clarify the illustration:

- Slowlane: Work → Get Paid → Save → Invest → Retire → Enjoy the Results

- Fastlane: Build assets → Leverage technology/systems → Multiplied income in a short period → Enjoy the results while still young and productive

If you are just waiting for “time” to make you wealthy, you are letting externalities dictate your life. The Fastlane teaches you to create a system that enables income independent of external factors.

Self-Education: The Key to Adaptation & Income Growth

Many people assume the learning process ends with a diploma in hand. However, DeMarco emphasizes that formal education is just basic training. The world changes too quickly if you rely on static knowledge. Innovation, technology, and new opportunities are constantly emerging—and only those who actively seek new knowledge can capitalize on them.

MJ DeMarco himself is a real-life example: when he started building his internet media business, he didn’t know how to create a website, design, manage servers, or even do copywriting. Was that an obstacle? No. Because self-education is the lifeblood of Fastlaners. He learned, experimented, and delved into various resources until he mastered the required skills [1].

Some important habits for becoming a “great self-learner”:

- Not being afraid to fail when learning new things

- Utilizing online resources, books, forums, and productive communities

- Cultivating a “can-do” mindset

- Regularly updating skills to stay relevant

It’s important to remember: postponing learning will only slow down your progress. Deliberate and self-directed education is the true wealth accelerator, not just a certification without added value.

“However, there are three common mistakes that often occur when starting self-education, from choosing the wrong learning resources to failing to maintain consistency. All strategies to overcome them are covered in MentorBuku’s exclusive summary…”

Read also : CEO Excellence by Carolyn Dewar

How to Become a Great Self-Learner and Win in the Digital Era

How can you get started? The secret lies in the balance between curiosity and discipline. Start with a small project, like building your own portfolio website, and document your learning steps and mistakes along the way. If you encounter obstacles, don’t be quick to give up.

“Excuses are like a plastic bag ready to smother your dreams, but only if you stick your head in the bag. Instead, my vision didn’t end with ‘I don’t know how’, but started there.” Take inspiration from this quote: The journey to success begins precisely at the point of “not knowing how” [1].

“Advanced techniques for building self-learning skills, as well as a list of the most effective online learning resources, are all reviewed step-by-step in MentorBuku’s award-winning summary…”

Customer Service: The X-Factor for Boosting Reputation and Profit

One expensive lesson in the business world: a great product can be ruined by poor service. DeMarco’s personal experience at a luxury hotel in Italy serves as a real-life illustration. Although the hotel’s architecture was magnificent, the service was chaotic: unresponsive employees, unkept promises, and convoluted processes. Instead of fond memories, all that remained was disappointment.

This is where the role of customer service lies. More than just fulfilling promises, “living” customer service provides an unforgettable experience and maintains loyalty. In fact, a single incident of poor service can render the investment in product quality useless.

There are two important lessons:

- The service philosophy must be embodied by all employees, not just be a slogan on the wall.

- No matter how good your product is, its reputation can still be ruined by a poor customer experience.

Improving customer service means designing every interaction to reflect your brand’s vision, as well as building strong communication between management and frontline staff.

“Concrete solutions and templates for building world-class customer service—including a ready-to-use checklist—are available exclusively as part of MentorBuku’s insights…”

Read also : The Power of Positive Thinking by Dr. Norman Vincent Peale

Case Study: A Costly Failure Due to Poor Service

Have you ever been disappointed by a business that was supposed to be “premium”? Perhaps you ended up remembering the bad experience more than the product’s grandeur. Unfortunately, a damaged reputation is difficult to restore. Bad service can spread even faster, especially in the age of social media.

World-class businesses always start with the mindset: “Every team member is a service ambassador.” The company’s vision is not just communicated, but also translated into action on the ground by every employee.

“A list of real case studies and recruitment techniques for the best customer service teams are dissected in detail in the book and MentorBuku’s Premium summary…”

Conclusion: Starting Your Fastlane Journey

We have dissected three keys to transformation according to “The Millionaire Fastlane”: (1) shifting your mindset and strategy from the Slowlane to the Fastlane, (2) actively building knowledge through self-education, and (3) protecting your business’s reputation through world-class customer service. These three are not just theories—they are foundations that have been tested by modern successful individuals.

The next step is the courage to initiate change. Are you ready to challenge the mainstream, actively learn new things, and improve all aspects of service in your business or career? It all starts with one small decision today: changing your mindset and taking immediate action.

However, don’t stop here. Technical guides, practical checklists, and a breakdown of fatal mistakes when implementing the Fastlane concept—all await you at MentorBuku.

You’ve just seen the foundation. These concepts are merely the tip of the iceberg of what this book offers. How do you apply them step-by-step, avoid common pitfalls, and integrate them into your strategy? All the answers are inside.

Register and Get Free Access at MentorBuku Now!