Personal finance is often a confusing topic for many people. With various concepts and strategies circulating, we may feel stuck. In this article, we will discuss some key concepts from the book I Will Teach You to Be Rich by Ramit Sethi, which offers a practical approach to managing finances and investing money. Through this article, you will understand the importance of good financial management and the motivation behind making strategic financial decisions.

Why Is Personal Finance Important?

Before we discuss practical steps, let’s take a look at why managing personal finances is so important. Good financial health allows us to:

- Meet our daily living needs.

- Prepare for the future, including retirement.

- Handle emergencies without excessive stress.

By understanding the basics of personal finance, you open the door to greater financial freedom and the ability to pursue your dreams without financial barriers.

Read also : Master Your Emotions by Thibaut Meurisse

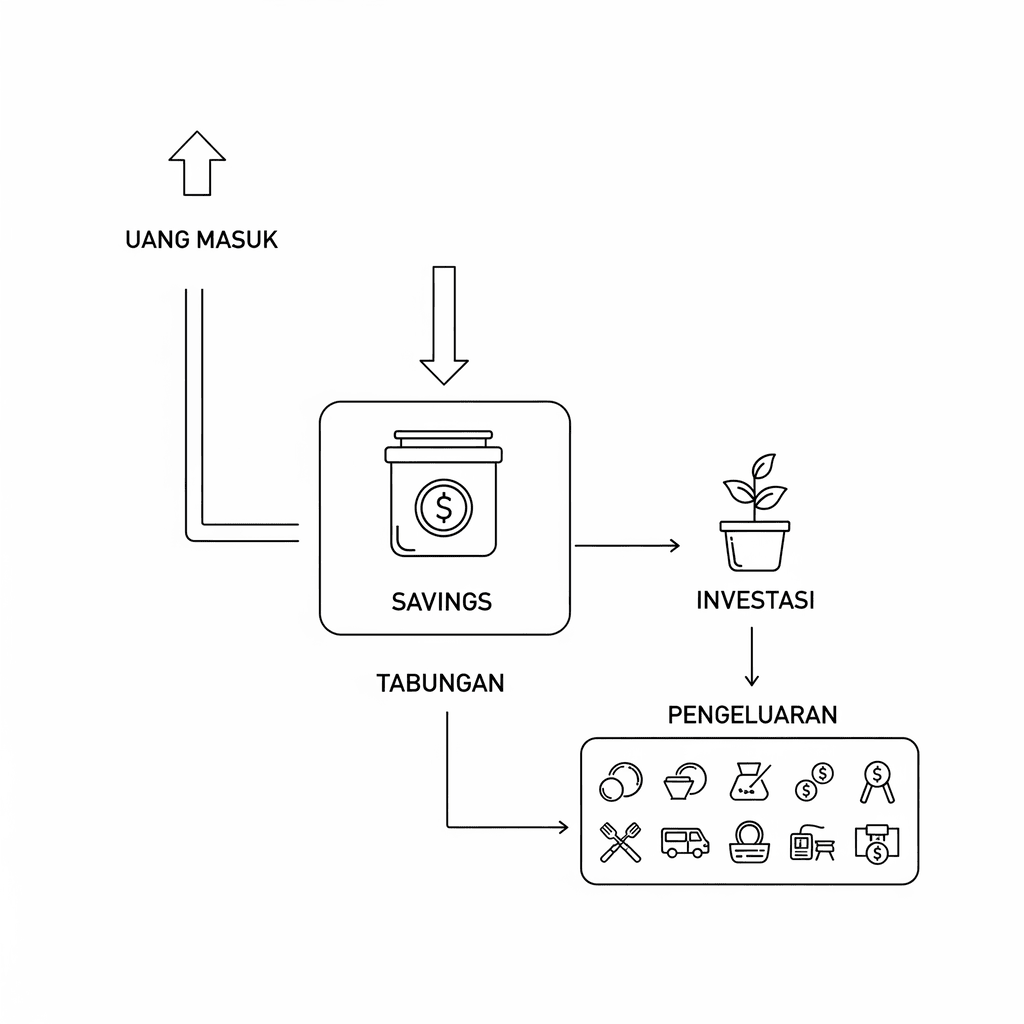

Concept 1: Understanding Budgeting

One of the first things you need to do is understand budgeting. Managing a budget means knowing how much money you have, how much you spend, and where your money goes. In this book, Sethi shows that budgeting doesn’t have to be complicated.

He recommends starting by setting allocations for certain spending categories. For example, you can allocate specific amounts for food, transportation, and entertainment. It’s important to recognize that most people don’t account for unexpected expenses, such as hospital bills or home repairs.

However, there are three common mistakes people often make when trying to create a budget, which are explored in depth in our summary…

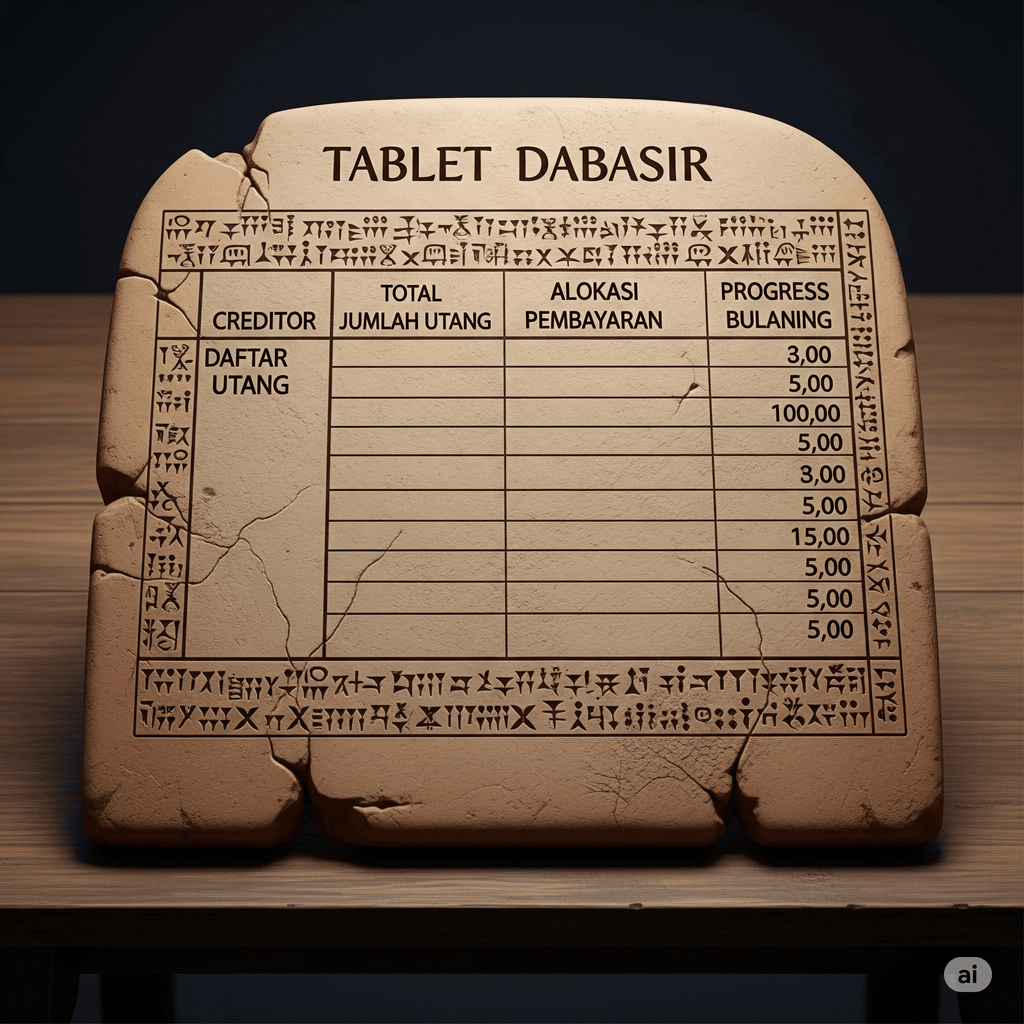

Concept 2: Using Credit Cards Wisely

Credit cards can be a double-edged sword. On one hand, they offer convenience in transactions and reward bonuses, but if used carelessly, they can lead to severe debt. In his book, Sethi discusses strategies for using credit cards responsibly.

Among his suggestions are paying off the full balance every month and using credit cards only for planned purchases. This helps you build good credit without falling into debt.

A complete framework for applying smart credit card strategies is discussed in five specific steps in the book…

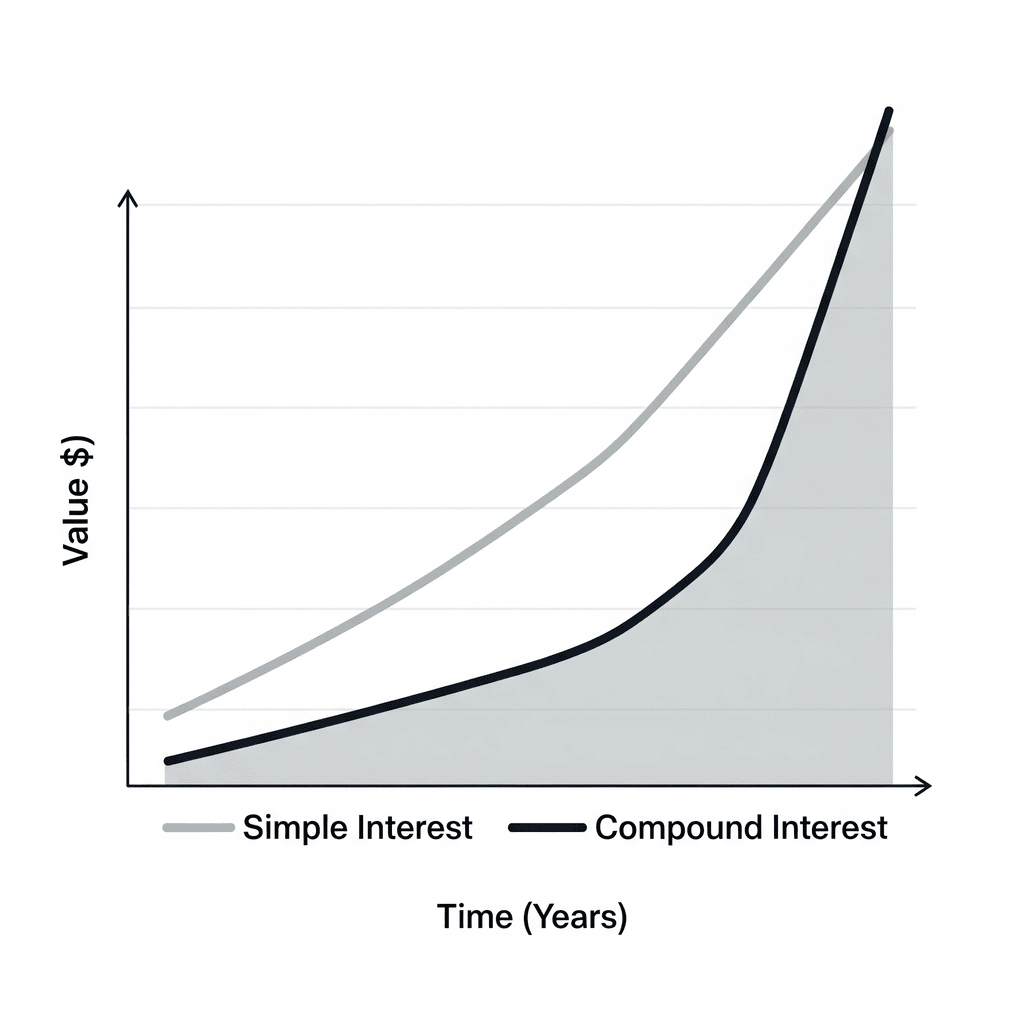

Concept 3: Investing Early

Once you have a solid foundation in budgeting and debt management, it’s time to consider investing. Sethi explains that starting to invest early allows you to leverage the power of compound interest.

For instance, if you start investing at age 25 rather than 35, your total investments by the time you retire could differ dramatically. Investing doesn’t have to be complicated; you can start by opening a basic investment account or joining a mutual fund.

However, you’ll find several effective ways to start investing explained in detail in this book…

Concept 4: Building an Emergency Fund

Everyone needs an emergency fund to deal with unexpected situations. Sethi recommends starting by allocating a small amount each month (for example, $50) until you reach a sufficient sum.

However, it’s very likely that this amount won’t be enough. Learning from experience and planning the ideal amount for your emergency fund is a crucial step in financial risk management.

Advanced techniques for building an emergency fund, including strategies for gradually increasing your allocation, are part of the exclusive insights we’ve prepared at MentorBuku…

Read also : The Power of Habit by Charles Duhigg

Conclusion: Building a Bright Future

By applying the concepts above, you will be on the right track toward better financial health. Remember, managing finances is an ongoing process. Consistency and adjustment are key to achieving success.

You’ve just seen the foundation. These concepts are just the tip of the iceberg of what this book has to offer. How do you put them into practice step by step, avoid common pitfalls, and integrate them into your own strategy? All those answers are inside.

Sign up and get free access at MentorBuku now!