Revealed! 4 Powerful Financial Secrets from The Richest Man In Babylon

Introduction: Why Babylonian Financial Principles Are Still Relevant

Have you ever wondered why some people seem to have the “Midas touch” with their finances? Or why some emerge from a financial crisis even stronger? The answer, it turns out, was locked away and passed down thousands of years ago by the ancient citizens of Babylon—the wealthiest city of the ancient world. Through “The Richest Man In Babylon,” we learn that financial success never comes by chance. It is born from wisdom, habits, and systematic strategies that continue to resonate in the modern financial world today [1].

In a fast-paced world full of distractions, many of us forget the fundamental principles that made Babylon a symbol of prosperity. This book asserts: prosperity is a result of personal wisdom and discipline. Simply put, financial strength is the fruit of discipline and a sharp understanding of money and how it works [1].

This article will unlock four key principles—from the art of managing money, building personal habits, and strategies for getting out of debt, to how to turn a surplus into a money-making machine. However, you will soon discover that even with the foundation in hand, applying these steps in reality is an art in itself.

Read also : Emotional Intelligence by Daniel Goleman

The Art of Money Management: Managing Money with Discipline

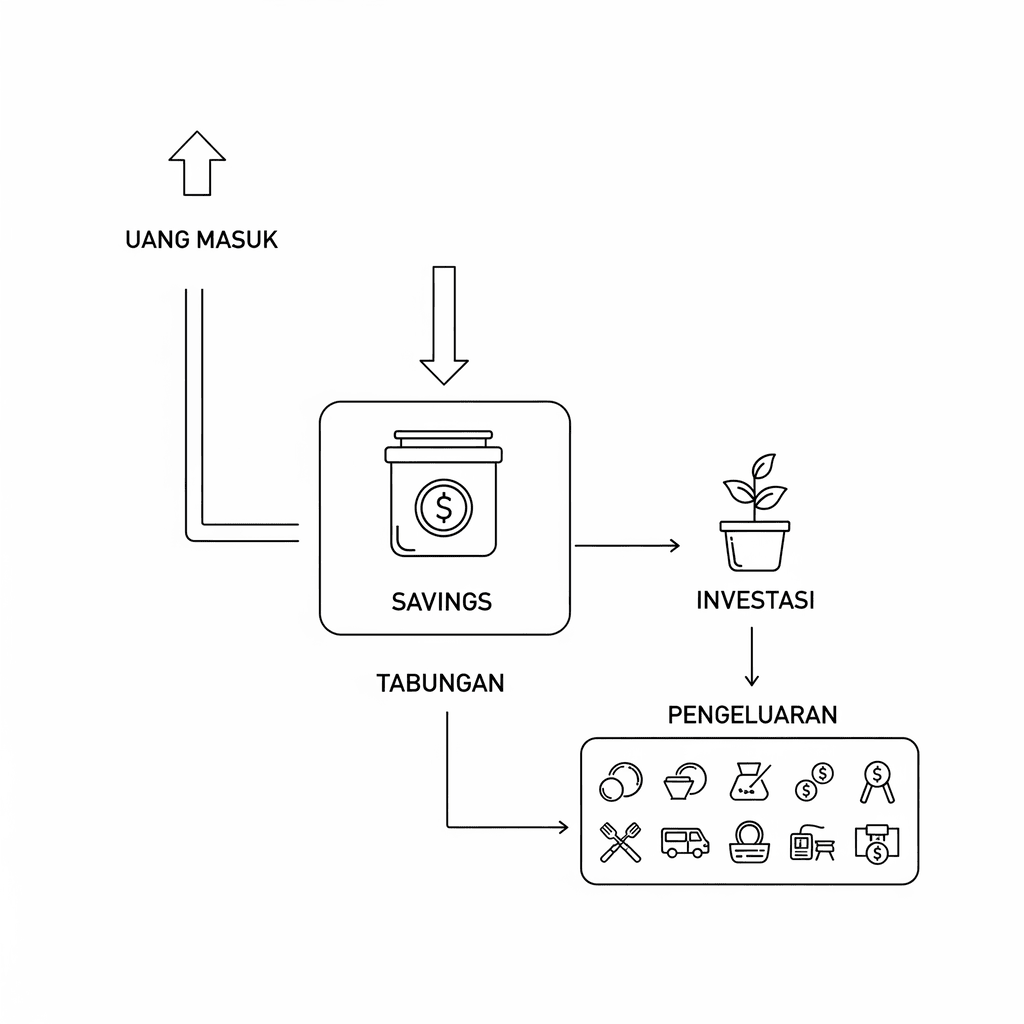

“The Babylonians became the wealthiest because they understood the value of money and were disciplined in managing it,” according to the book [1]. The principle of money is not just about income, but how you save, spend, and grow it. The Art of Money Management is the first pillar: How one consciously limits spending, invests strategically, and ensures that every coin works hard for its owner.

The book emphasizes the need to pay yourself first, a revolutionary paradigm even in modern times. By setting aside a portion of every income before anything else, you create the foundational habit of ‘saving first, spending later’. Furthermore, the discipline to resist the temptation of a lavish lifestyle and impulsive consumption is seen as a financial fortress.

Behind the simplicity of this principle lies a specific framework that ensures your savings are not merely ‘saved’ but truly grow. The complete framework, including allocation tips and automation methods, is detailed step-by-step in MentorBuku’s internal guide and the summary of the original book.

The complete framework for implementing this art of money management is discussed in 5 specific steps within the book…

Read also : Effortless by Greg McKeown

Personal Habits: The Foundation of Financial Strength

This book highlights a frequently overlooked fact: Habits shape our personal financial ecosystem [1]. Every small action—from tracking expenses and reviewing assets to reinvesting interest—contributes to the accumulation of wealth. However, not all habits are productive. There are mindsets like ‘money is the enemy’ or ‘just getting by is good enough’—two afflictions that erode opportunities like termites.

The Babylonians emphasized the importance of mental preparation before taking action. They knew, “financial realization is only possible when supported by wise thinking and deep understanding.” This mindset becomes the catalyst for every decision: from conservative investments to more aggressive strategies, it all begins with the habit of daily reflection.

On the other hand, building positive financial habits is not instantaneous. There are stages, practice techniques, and effective “daily reminders” to ensure the change becomes truly permanent in both your nervous system and your wallet.

However, there are three common mistakes that often occur when trying to build financial habits, which are dissected in detail in our summary…

A Structured Plan to Escape the Trap of Debt: Inspired by Dabasir

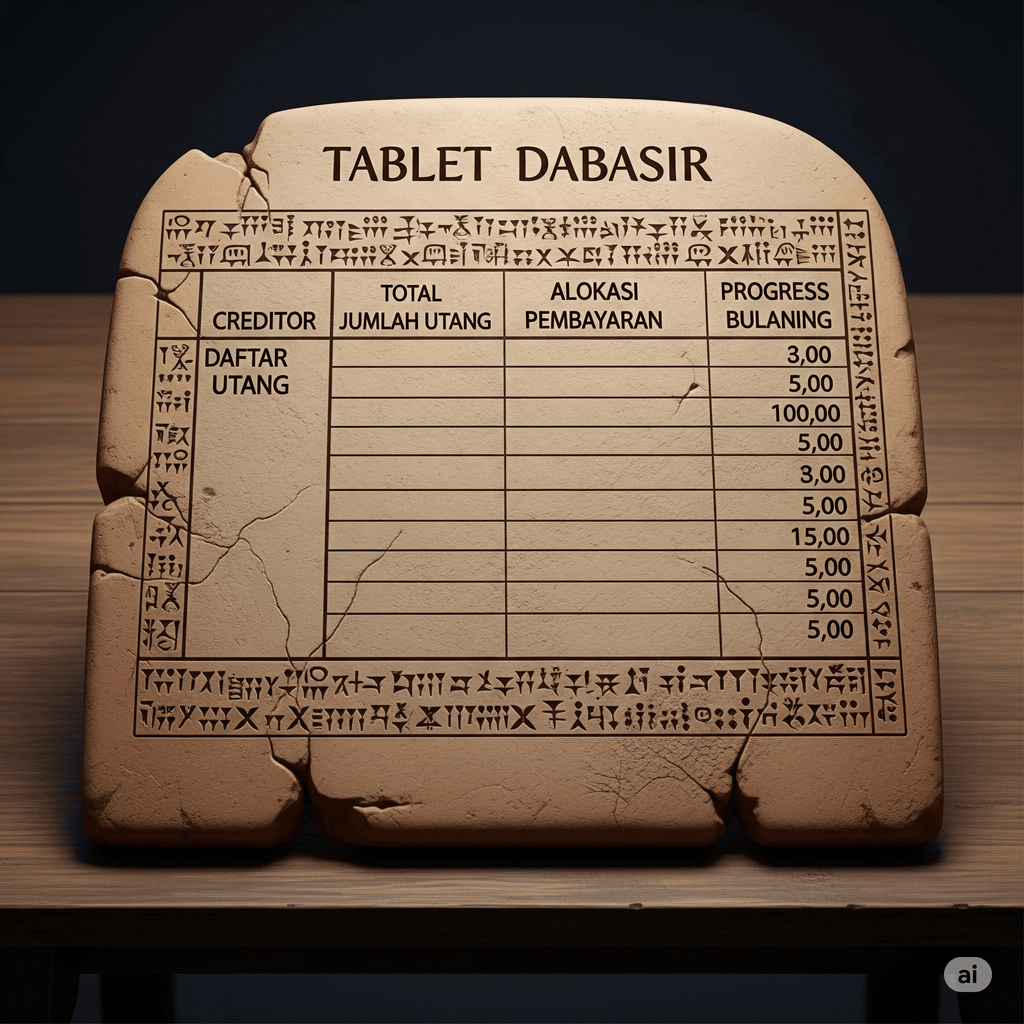

This book isn’t just about accumulating money, but also about how one can escape from the most frightening financial abyss: debt [1]. The story of Dabasir from Babylon is monumental—he returned from slavery, wrote down a detailed plan, and then paid off his debts one by one.

What made Dabasir’s strategy so effective? He didn’t merely intend to pay off his debts. He created a phased payment system, set specific goals, and wrote them down as a “covenant on clay tablets” for personal accountability. Every step was calculated, from the payment amounts to the allocation for basic needs and future goals.

This similar strategy is now widely adapted into the “Debt Snowball” or “Debt Avalanche” methods in modern financial literature, but its historical roots and psychological depth are unique to Dabasir and the citizens of Babylon.

Advanced techniques from this concept, including a template for creating an effective debt repayment plan, are part of the exclusive insights we have prepared at MentorBuku…

Read also : The 7 Habits of Highly Effective People by Stephen R. Covey

The Secret to Building Sustainable Wealth with a Surplus

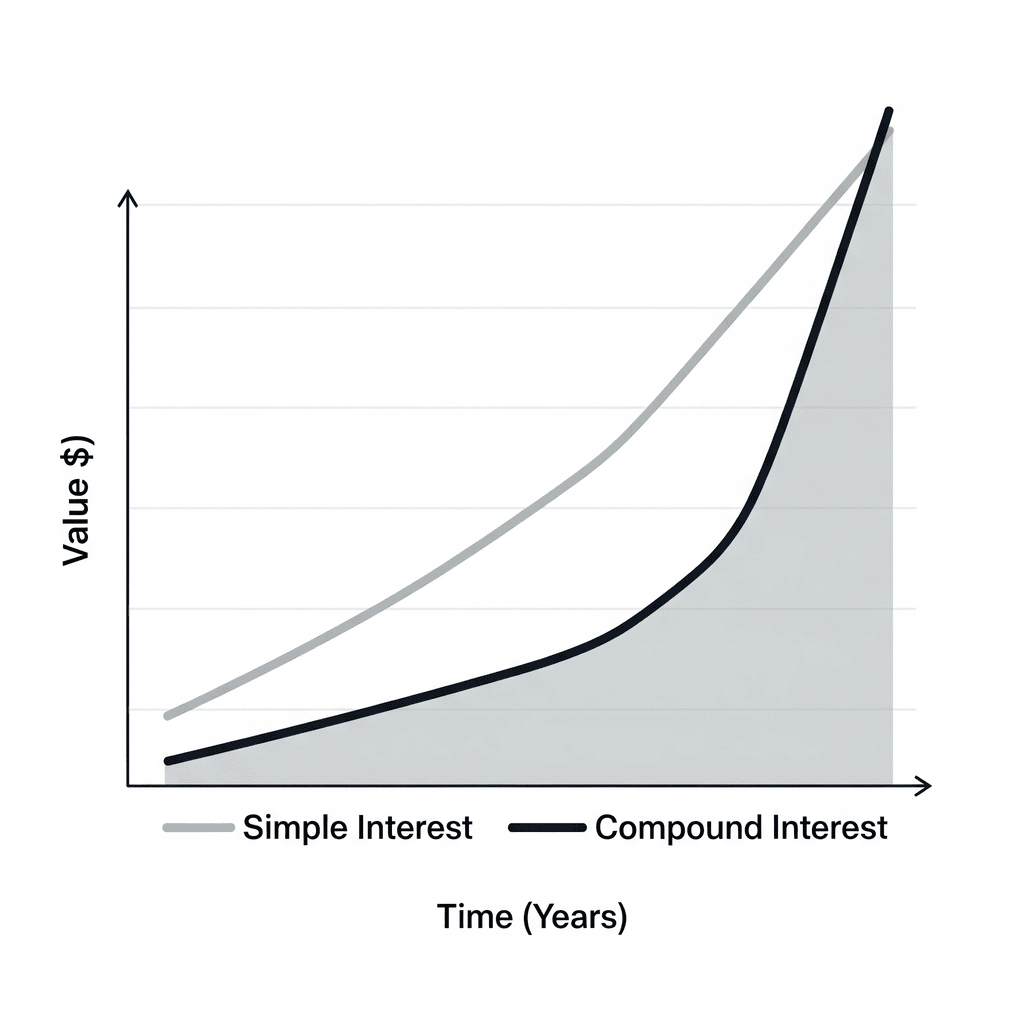

The Babylonians were not just masters at eliminating debt; they were also creators of a “surplus machine”—extra income that was never idle. The book teaches that idle money is a wasted opportunity [1]. Every surplus doesn’t just sit in savings but is put to work to grow—through investment, business ventures, or being reinvested as capital.

However, accumulating a surplus requires both psychological and technical processes: resisting subconscious consumption urges, identifying safe investment opportunities, and managing risk. In modern times, their strategies remain relevant—from mutual funds and stocks to small businesses—the key is the “surplus first” behavior.

How to find surplus opportunities, avoid fraudulent investment traps, or maximize returns—all are dissected in detail in the deeper chapters of the book and at MentorBuku.

Specific techniques for creating a sustainable surplus, as well as a safe investment checklist, are an exclusive part of MentorBuku’s recommended module…

Read also : BRS PHYSIOLOGY by Linda S. Costanzo

Conclusion: A New Chapter in Your Finances Begins Here

The four financial secrets from The Richest Man In Babylon are not just history, but an actual roadmap. You now understand the power of money management, the urgency of building good habits, the effective strategy for getting out of debt, and the secret of circulating a surplus. These four are the puzzle pieces to financial freedom. However, all of this is just the entry point. “How” to translate each principle into daily routines and decisions? This is where the need for further guidance becomes essential.

You’ve just seen the foundation. These concepts are just the tip of the iceberg of what this book offers. How to apply them step by step, avoid common pitfalls, and integrate them into your strategy? All those answers are inside.

Sign Up and Get Free Access at MentorBuku Now!

Leave a Reply