Smart Investment Strategies: Reducing Risk and Maximizing Profits

Investing is one of the best ways to achieve financial freedom. However, without the right strategy, the risk of loss remains high. This article will discuss important concepts that can help you invest more intelligently, reduce risk, and increase your chances of maximizing profits.

Why Does Investing Require a Special Strategy?

Investing is not just about putting money in and hoping for results. Without a solid strategy, investors are vulnerable to substantial losses from unexpected market fluctuations. Therefore, understanding the basic principles and applying specific techniques is essential.

Risk can never be completely avoided. However, with the right approach, risk can be significantly minimized. How? Let’s explore the key concepts that form the foundation of successful investing.

1. Assessing Company Quality Before Investing

One of the main indicators to pay attention to is a company’s quality. According to the guidelines from “The Intelligent Investor,” companies with the highest credit ratings usually attract major speculators because they are implicitly considered to have bright prospects [1].

However, keep in mind that companies that stand out in terms of credit often attract excessive speculation. So, it’s important not to blindly follow the crowd without thorough analysis.

Read also : Can’t Hurt Me by David Goggins

The complete framework for assessing a company is discussed in five specific steps that will help you determine whether a company is worth investing in.

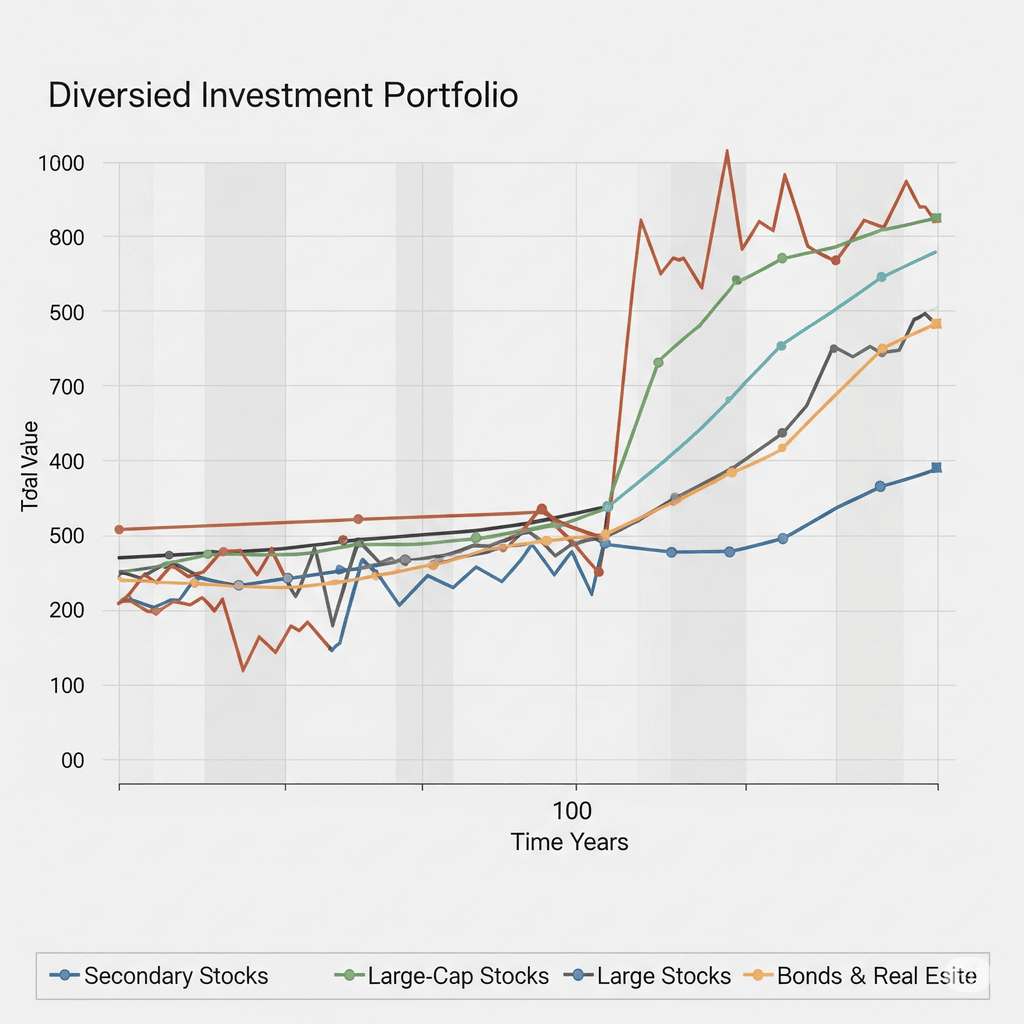

2. Managing Investments in Secondary Companies

In addition to leading companies with good reputations, there are also secondary companies that demonstrate stable performance and have a positive track record. They usually don’t attract much public attention and offer different risk opportunities.

Understanding the characteristics of these types of companies will help diversify your portfolio and reduce dependence on a single asset class. But how do you select and manage investments here? The full techniques are supported by findings from our investment strategies.

Read also : The Dictionary of Body Language by Joe Navarro

3. Avoiding Common Pitfalls in Stock Valuation

There is a trend where many investors, even professionals, use advanced mathematical formulas to determine stock value, especially those related to future growth. Unfortunately, a combination of formulas and inaccurate assumptions can actually justify misguided valuations [1].

One of the biggest traps is believing that future projections will definitely match the calculated numbers. In reality, the market is very dynamic and cannot be predicted with certainty.

Advanced techniques for this concept, including templates and practical examples, are part of the exclusive insights we’ve prepared at MentorBuku…

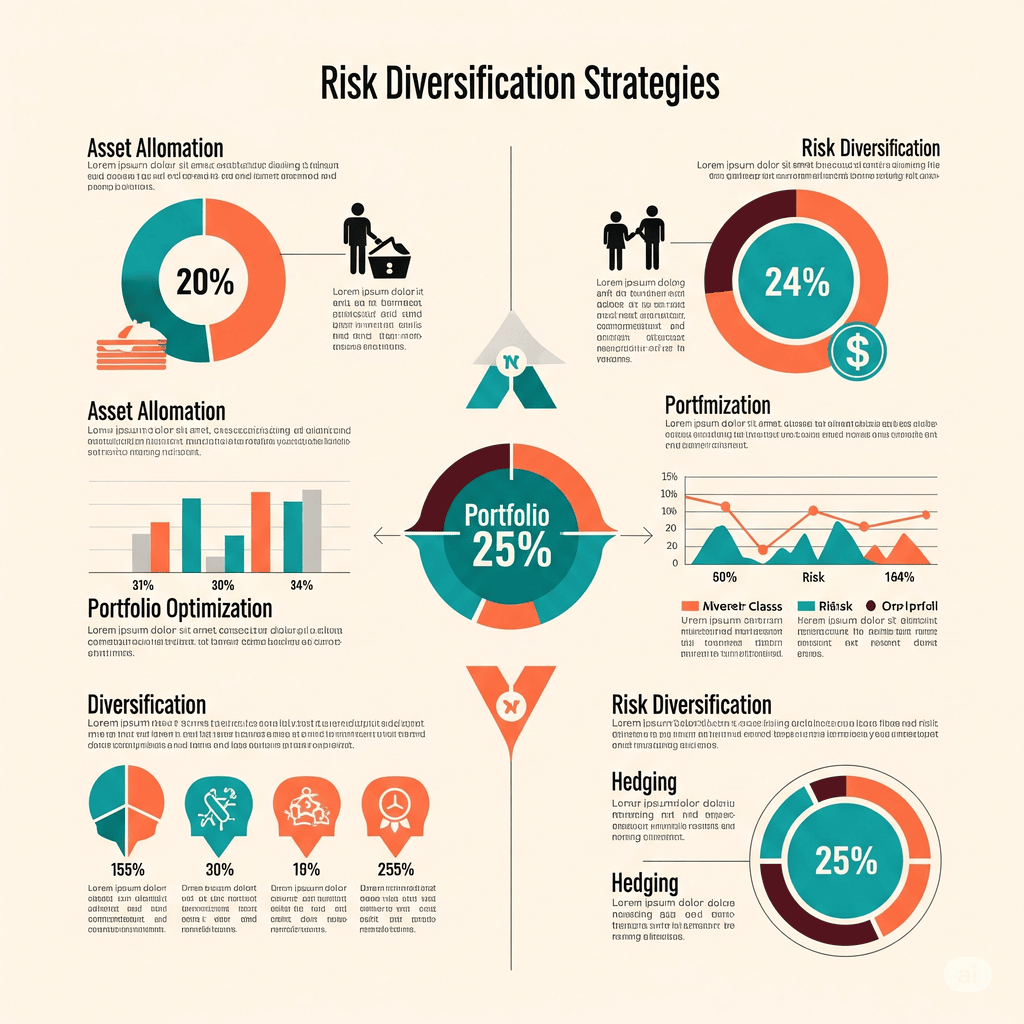

4. Practical Strategies to Reduce Risk

- Asset diversification: Spread investments across different sectors and instruments to reduce overall risk.

- Fundamental analysis: Focus on the quality and potential of companies, not just market trends.

- Active risk management: Set stop loss and take profit levels with discipline.

Read also : Start with Why by Simon Sinek

Understanding and applying these concepts will help you avoid common traps and build a more resilient portfolio.

Conclusion: What Should You Do Now?

Smart investing is not about luck, but about strategy and a well-thought-out process. By knowing how to assess companies, diversify, and manage risk with discipline, you will be on the right track toward financial success.

Read also : The Almanack of Naval Ravikant by Eric Jorgenson

Time to Take Action!

You have just seen the foundation. These concepts are only the tip of the iceberg of what this book has to offer. How do you apply them step by step, avoid common pitfalls, and integrate them into your strategy? All those answers are inside.

Sign up and Get Free Access to MentorBuku Now!