Introduction: Why the World of Work Must Be Completely Overhauled

Imagine if you could flip the work paradigm: more free time, a steady flow of income, and freedom from the trap of daily routines. The book “The 4-Hour Workweek” doesn’t just offer a dream; it strips away conventional ways that have imprisoned workers, entrepreneurs, and even visionaries. But why do most people still get stuck in the old model? Because they haven’t truly understood the main catalysts, how the paradox of time and value work together, and—most importantly—the fundamental mistakes almost everyone makes when first attempting this revolutionary strategy.

This article uncovers three key gems: the “minimal work, maximum results” paradigm, the freedom-inducing architecture of automated businesses, and fatal traps you must beware of. However, we are only peeling back a few layers—not providing step-by-step technical guides. To transform your life, you need to understand the “why” before diving into “how.”

Minimal Work, Maximum Results Paradigm: The Liberating Paradox

One of the greatest revolutions from this book is the destruction of the “hard work = big results” mentality. The author dismantles the old myth, replacing it with one key question: “If I could only work 4 hours a week, what would I do differently?”

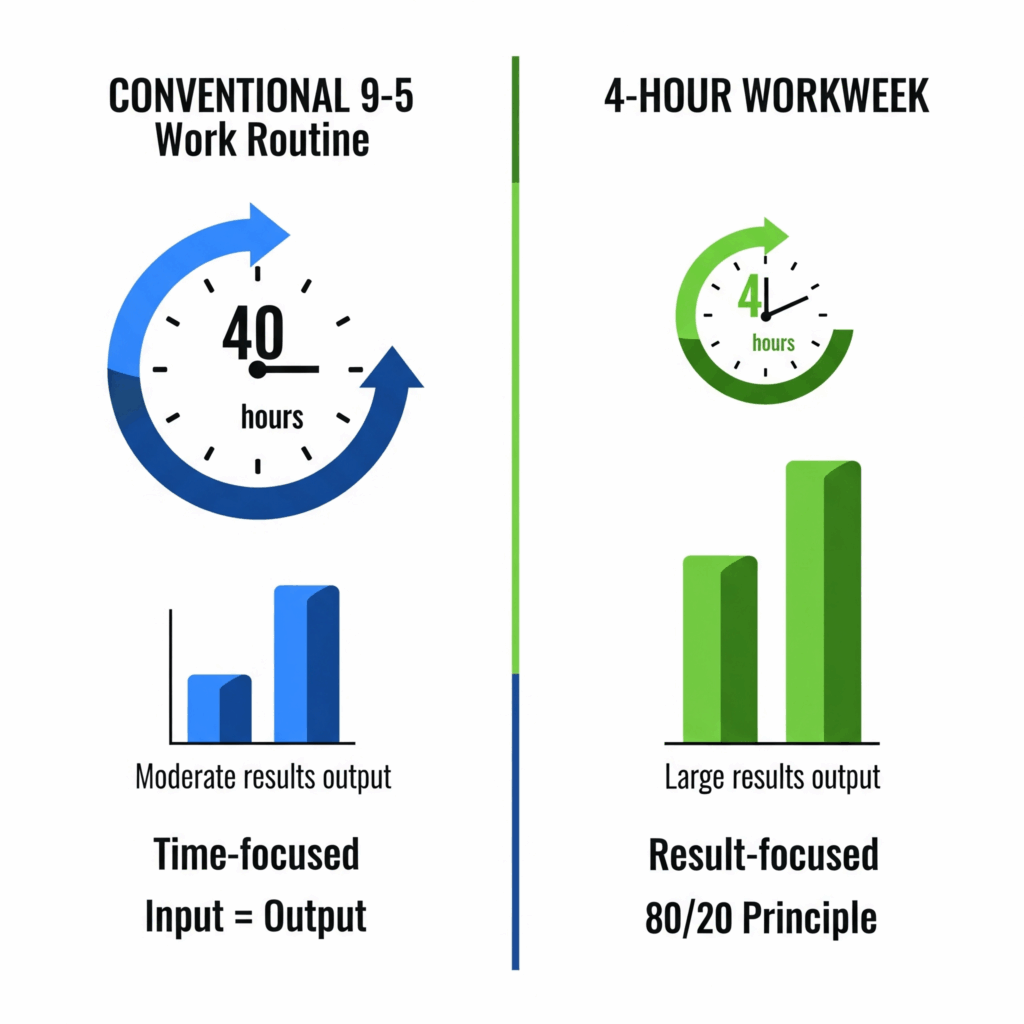

This paradigm doesn’t mean you become lazy or neglect your responsibilities. On the contrary, you’re required to be radical in selecting and cutting activities: focus only on the highest-value work. With the 80/20 principle, you are encouraged to identify the 20% of activities that generate 80% of the results. This is the main catalyst that breaks the binds of work hours.

Moreover, this new paradigm challenges your perception of what you truly want from life: time, mobility, or money? Most workers and business people become absorbed in routines without ever re-evaluating their life goals.

However, after realizing the importance of cutting work hours and choosing high-value activities, a tempting question arises: “How exactly do you map out your 20% activities? The technique for filtering priority activities used by the author is taught only in the original book…”

Automated Business Architecture: Turning Ideas into Money While You Sleep

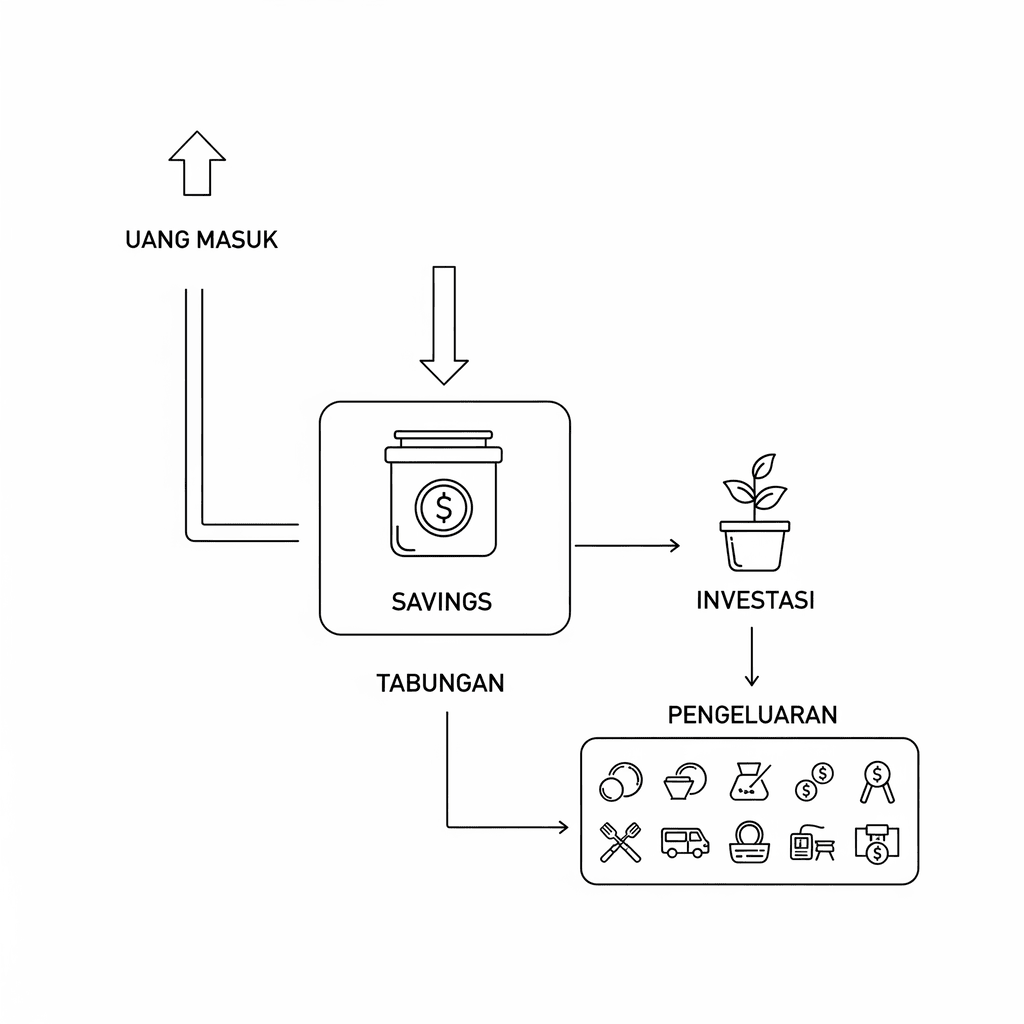

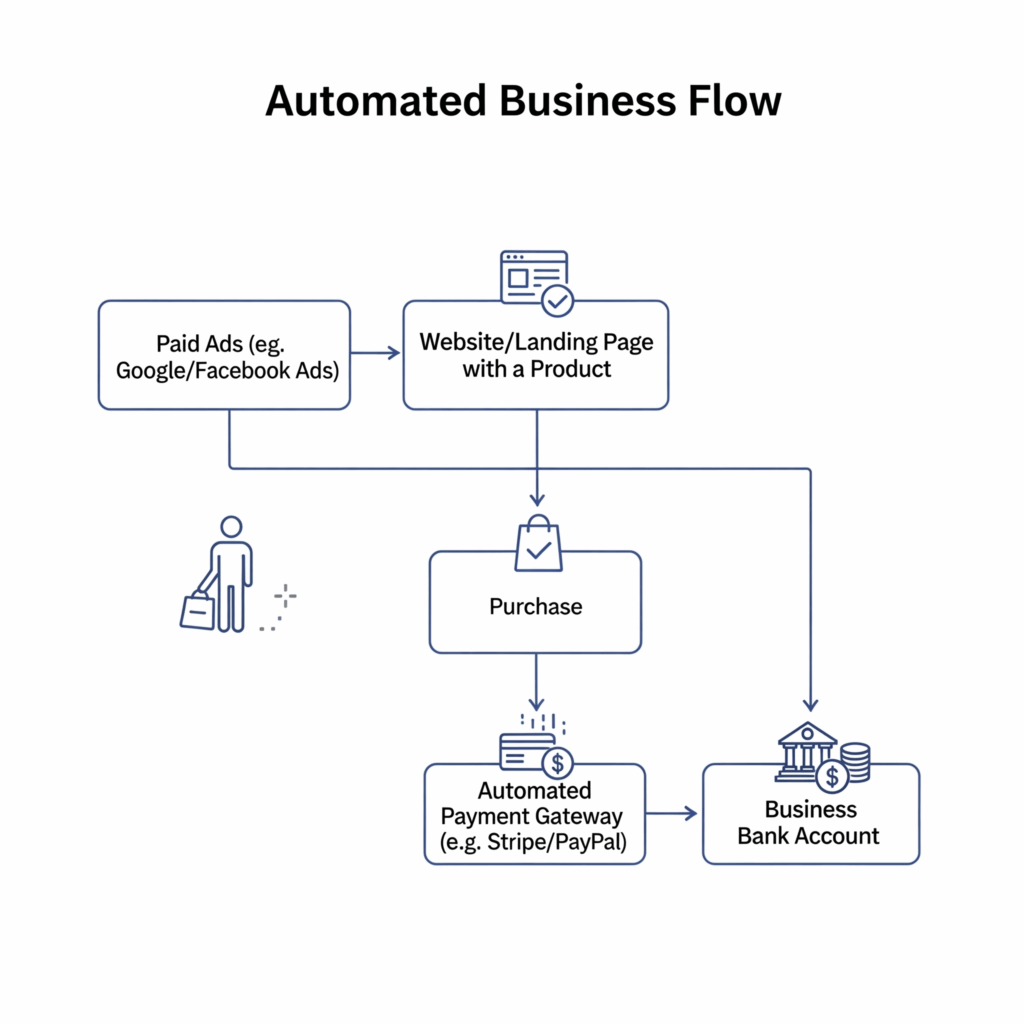

One of the most compelling sections of this book discusses the architecture of automated business systems. Instead of becoming a “forever worker” in your own company, you’re encouraged to build a business model that requires minimal intervention. There’s a simple diagram that illustrates the flow of money: from advertising (online/offline), to a landing page, to automatic payment processing, and finally—money flows into your account without you being physically or mentally present.

This concept is the backbone of the “minimal work, maximum results” lifestyle. With automation integration, you can truly become “invisible” behind the scenes—even as your business keeps running and the money keeps coming in.

This is where the revolution lies: you don’t need to be a tech expert to piece together this architecture. For example, many start with a simple product idea, then run ads and rely on automated payment systems so that orders keep coming in 24/7. However, an important question arises: “The technical steps, tools, and detailed costs required are only explained step-by-step in the architecture diagram and dedicated chapters of this book…”

Taking Smart Risks: The Zen Story Behind Star Wars

Freeing yourself from the old system isn’t just about business strategy, but also mental courage. Readers are introduced to real-life stories—one of them being Hans Keeling, who, after taking a huge risk (literally: jumping off a cliff and paragliding in Rio de Janeiro), found a new meaning to life amidst uncertainty.

Stories like these show that “The 4-Hour Workweek” is more than just a business blueprint. It’s an invitation to courageously face your fears, step outside your comfort zone, and open up new opportunities that previously only existed in dreams. The author often quotes legendary characters like Yoda: “Do, or do not. There is no try.” If you only procrastinate or hesitate, change will never come.

However, the strategies for resetting personal and mental risk taught in this book are never simply described outside of certain chapters. There are psychological checklists and in-depth questions that can only be found in the original guide.

Fatal Traps: Common Mistakes Almost Every Beginner Makes

Tangible failures of this concept usually stem from half-hearted understanding. Many people mistakenly believe that everything can be automated without knowing their priorities, or try to cut work hours without filtering for high-value activities. As a result, they actually become more stressed or lose control over their business and life.

Another common mistake is the obsession with “work freedom” before having a stable automated income model. In fact, the author warns: streamline your system, truly test the market, and maximize your minimum product or service before completely letting go of daily control.

Unfortunately, details about the three main mistakes and how to avoid them are discussed through real-life cases in the book. Often, real experiences from seminar participants and failed experiments become the foundation for fail-proof strategies.

Read also: Young Consumer Behaviour: A Research Companion by Ayantunji Gbadamosi

Read also: Introducing Economics: A Graphic Guide by David Orrell, Borin van Loon

Read also: Apartheid and the Making of a Black Psychologist: A Memoir by N. Chabani Manganyi

Case Studies, Experiments, and Behind-the-Scenes Secrets: What Makes “The 4-Hour Workweek” Different?

At the heart of this book are dozens of real-life examples—from seminar photo contests, simple experiments to crowdsource marketing content, to stories from families, doctors, and digital entrepreneurs breaking free from traditional work systems. Each case study fuels the reader’s inspiration to dare, fail, and then find their own breakthrough.

Even reports about how the author “killed the BlackBerry,” broke free from notification chains, and finally “became invisible” in his own business, act as key sparks for shifting mindsets.

But the most important question always arises: “How do I adapt all these case studies for myself? Templates, worksheets, and communication scripts are covered in depth only in the main source.”

Conclusion: Why This Book Is More Than Just a Business Guide

“The 4-Hour Workweek” is an idea catalyst, not just a collection of tricks. It challenges the status quo, teaches you to boldly reject routine, and redesigns life and work based on your deepest desires: freedom and meaning. However, the real secrets are hidden beneath layers of concepts that must be practiced in a structured way—and can only be fully accessed at MentorBuku.

You’ve just seen the foundation. These concepts are only the tip of the iceberg of what this book has to offer. How do you implement them step by step, avoid common traps, and integrate them into your strategy? All those answers are inside.

Sign Up and Get Free Access at MentorBuku Now!